BORROW AS YOU NEED IT!

With a Home Equity line of credit from Widget Financial, you have the flexibility to borrow from the equity in your home as you need it!

Take advantage of our 10 year draw period with two flexible payment options

- Variable rate with interest-only payments

- Lock in a fixed rate for a balance of at least $5,000

Click and drag to reveal

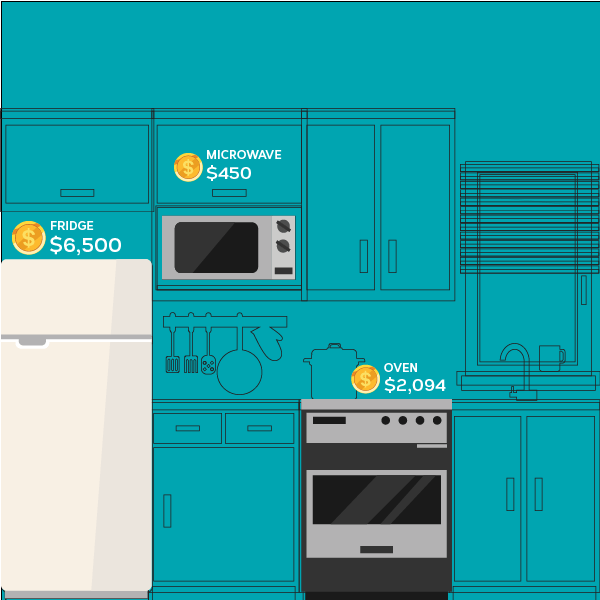

Steps to using your Home Equity Line of Credit

Step 1

Complete your project using your Home Equity Line of Credit.

Step 2

After your project is complete, lock in a low fixed rate.

Step 3

Make payments on your balance. As you pay, those funds will be available for future purchases on your line of credit.

HELOC Rates