Features

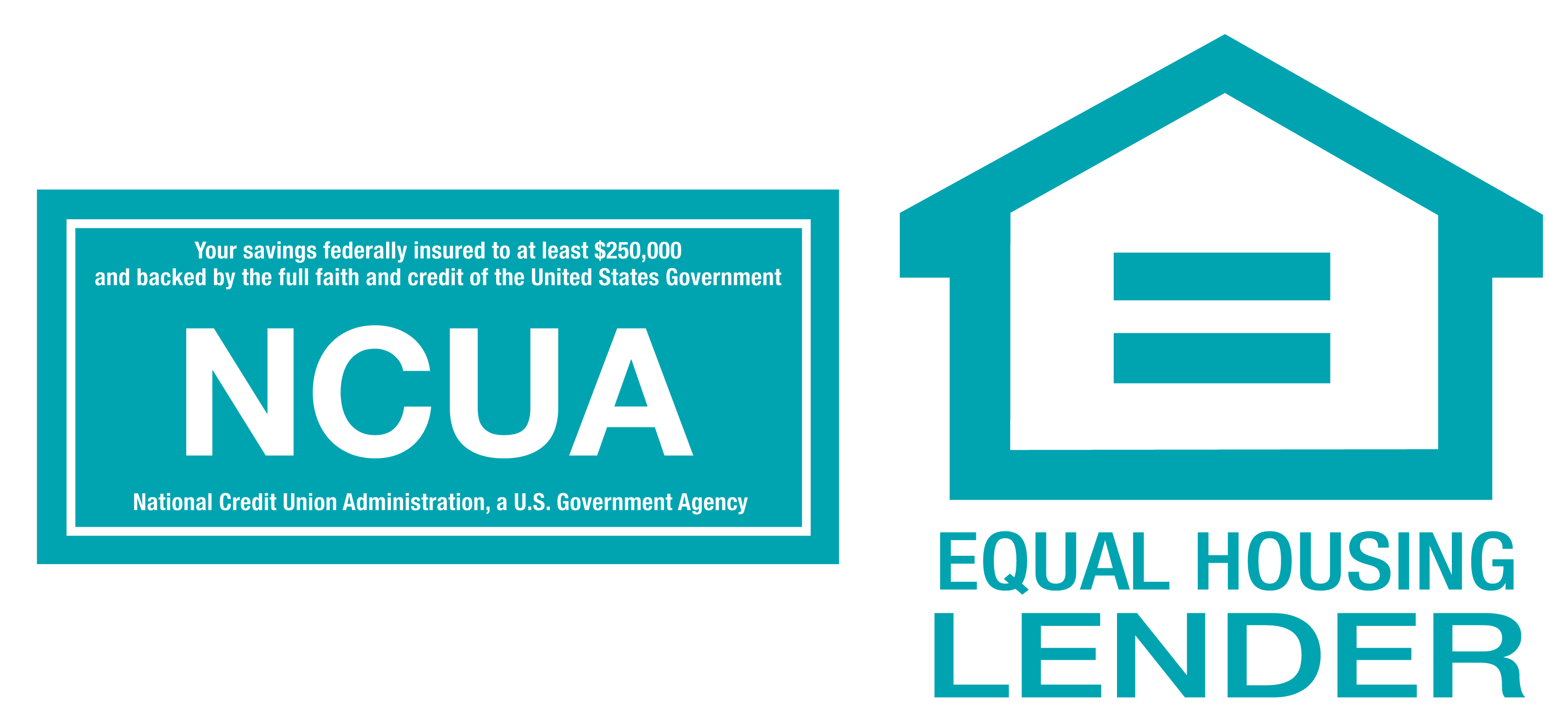

Credit Score Monitoring

Stay on Top of Your Credit

Your credit score plays a big role in your financial life—and now it’s easier than ever to track it inside your Widget Financial app. With our new Credit Score tool powered by SavvyMoney, you can:

- Check your score daily without affecting it

- See your full credit report anytime

- Receive instant alerts if something changes

It’s all free, built right into digital banking, and designed to give you confidence and peace of mind about your financial health.

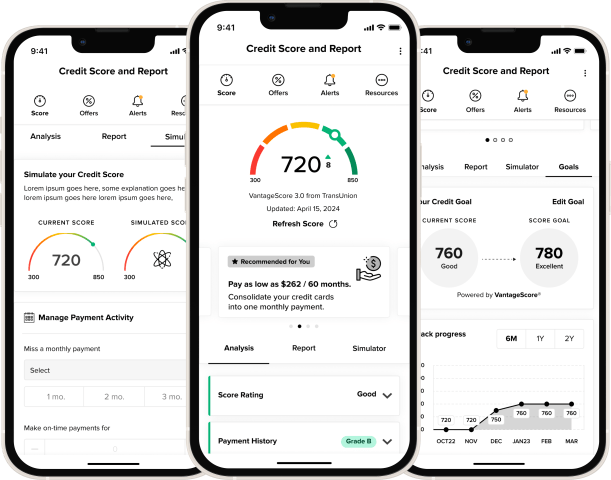

View External Accounts

All Your Accounts in One Place

Managing your finances shouldn’t mean juggling multiple logins. Our new platform lets you connect accounts from other banks, credit cards, or loans, so you can:

- See all balances together on one screen

- Track spending across multiple institutions

- Simplify budgeting with a single financial dashboard

- Stay organized with fewer logins and fewer apps to open

Bring everything together at Widget Financial and take control of your complete financial picture from one secure login.

Enhanced Bill Pay and Transfers

Simpler Payments, Faster Transfers

Paying bills and moving money shouldn’t be complicated. Our upgraded system makes it easier than ever to:

- Schedule, edit, or cancel bill payments quickly

- Set up recurring payments with just a few clicks

- Transfer funds between your Widget accounts instantly

- Send money to friends, family, or external accounts with ease

Whether it’s a quick transfer, a monthly payment, or paying someone back, the new tools give you more flexibility and speed—right from your phone or computer.