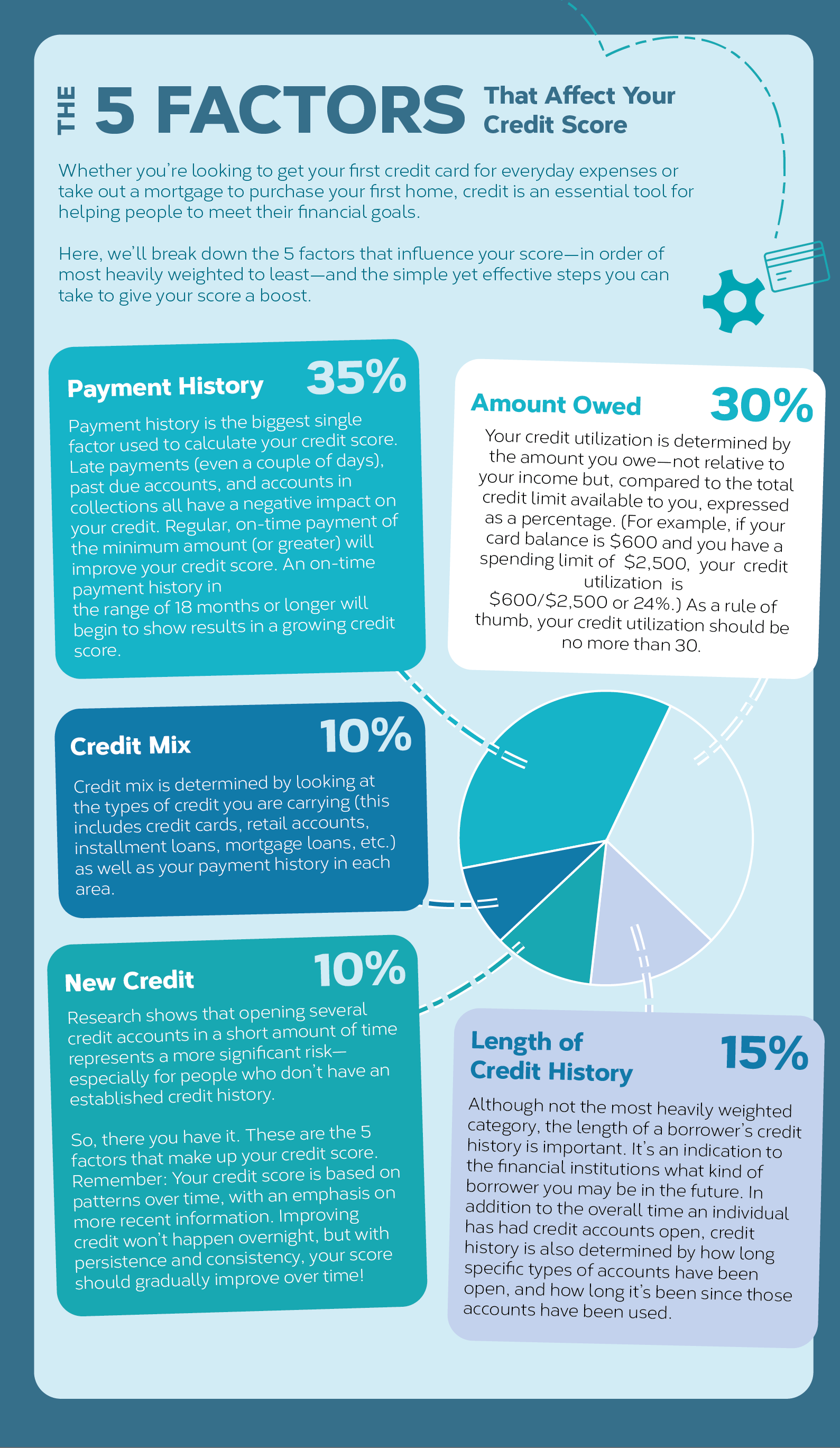

The 5 Factors That Affect Your Credit Score

Whether you’re looking to get your first credit card for everyday expenses or take out a mortgage to purchase your first home, credit is an essential tool for helping people meet their financial goals.

Here, we’ll break down the 5 factors that influence your score-in order of most heavily weighted to least-and the simple yet effective steps you can take to give your score a boost.